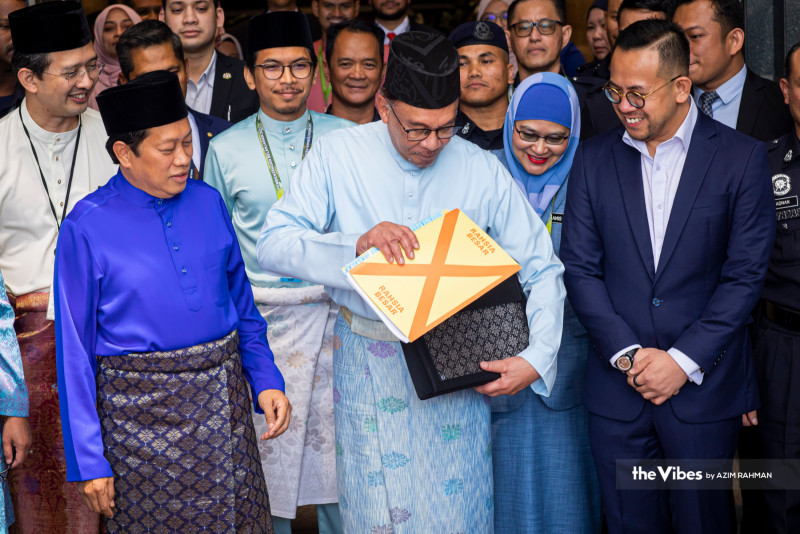

THE recently re-tabled 2023 budget by Prime Minister Datuk Seri Anwar Ibrahim, who is also the finance minister, was an astute document that emphasised continuity, reassured markets, and introduced small positive changes to signal future policy direction.

Astutely increasing fiscal space

Anwar and his team at the Finance Ministry very astutely adjusted the expected revenue and projected operating expenditure upwards, as compared with the budget announced by former finance minister, Datuk Seri Tengku Zafrul Abdul Aziz, now international trade and industry minister.

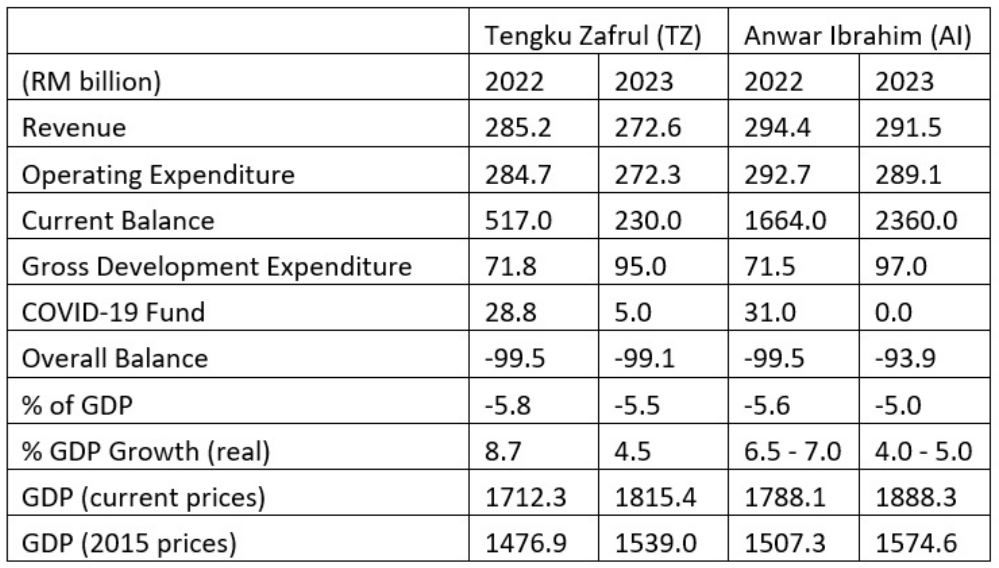

The higher-than-expected gross domestic product (GDP) growth of 8.7% for 2022 (compared with an initial projection of between 6.5% to 7.0%) allowed the team at the Treasury to increase the operating expenditure from RM272.3 billion (under Tengku Zafrul) to RM289.1 billion (under Anwar) and still announce a decrease in the budget deficit to GDP ratio from -5.5% (under Tengku Zafrul) to -5.0% (under Anwar).

The higher-than-expected GDP growth in 2022 also resulted in an increase in the projected revenue via direct and indirect taxes from RM285.2 billion to RM294.4 billion in 2022 and a projected increase in government revenue from RM272.6 billion (under Tengku Zafrul) to RM291.5 billion (under Anwar).

GDP (at current prices) or nominal GDP for 2022 was initially projected to be at RM1.71 trillion when Tengku Zafrul tabled the 2023 budget in October 2022 but has since been revised upwards to RM1.79 trillion representing an increase of RM75.8 billion or a 4.4% increase.

Nominal GDP is expected to increase to RM1.89 trillion at the end of 2023 compared with the projection of RM1.79 trillion when the 2023 budget was tabled in October last year.

Increasing fiscal transfers, tweaking development expenditure

The fiscal space created especially in the operating expenditure – amounting to an increase of RM16.8 billion or 6.2% compared with the 2023 budget tabled last year – allowed Anwar to target more funding in specific areas, especially to help the B40 community.

The total amount spent on subsidies, fiscal transfers, and incentives (which includes price support for essential items) increased from RM55 billion (under Tengku Zafrul) to RM64 billion (under Anwar) for 2023.

This increase was not so large as to “spook the markets”, but was significant enough to signal Anwar’s intention on helping the B40 community adjust to the increase in the cost of living that has taken place post Covid-19.

For example, the direct fiscal transfers to low- and middle-income families through the Sumbangan Tunai Rumah (STR) or the Household Cash Contribution increased from RM7.8 billion (under Tengku Zafrul) to RM8 billion (under Anwar).

Although total development expenditure (DE) was only increased by RM2 billion compared with the 2023 budget tabled last year, there were some useful tweaks in the allocation of the DE funding that can lay a good foundation for future expansion in the development expenditure when the country’s economic and fiscal conditions improve.

For example, the funding for high-impact projects under the International Trade and Industry Ministry (Miti) was increased from RM167 million to RM195 million.

Although the increase of RM28 million is not huge, it does signal to the industry that Miti is serious about its advocacy of working with industries to fund selected projects that have high multiplier effects on the economy.

The DE allocation for sports development at the state and community level was also increased by RM70 million. An additional RM50 million was allocated for much-needed maintenance of sporting facilities and sports complexes at the state level, and an additional RM20 million for sports development at the community level.

Under the Education Ministry, an additional RM250 million of development expenditure was allocated for educational support infrastructure.

Continuation of green economy initiatives

Although no new green economy initiatives were announced, it was encouraging to see the continuation of previously announced policies, including the extension of the Green Investment Tax Allowance and the Green Income Tax Exemption until December 31, 2025.

The Green Technology Financing Scheme guarantee of RM3 billion will also be extended until 2025. This continuity provides an important signal to the industry – for investments in battery energy storage systems from solar energy, for example – that the government is committed to expanding the green economy.

I am fairly confident that the ministers at Miti and the newly empowered Natural Resources, Energy and Climate Change Ministry will work together effectively to drive green initiatives moving forward, especially in the electric vehicle ecosystem, renewable energy, and industry-related initiatives in the ESG space.

More institutional reforms needed, especially under Minister of Finance Inc companies

The one area I wanted to see more clarity on, but was left out of this budget, was reforms involving MOF Inc companies. Not many people are aware of this, but almost one quarter of the DE is allocated to capital injections by the Finance Ministry amounting to RM23 billion, mostly to MOF Inc companies and other government agencies.

For example, the contingent liability for Prasarana had increased to RM40b at the end of 2021. Most of Prasarana’s revenue is spent on debt servicing associated with the building of the LRT and acquisition of buses and other assets, which means that it requires significant financial assistance from the Finance Ministry to continue to operate.

The National Higher Education Corporation Fund’s (PTPTN) contingent liabilities stood at RM40 billion at the end of 2021. How long will the unsustainable practice of offering student loans at below market interest rates continue, especially when PTPTN has to pay market interest rates for its funds and is asked to absorb the many discounts offered for early repayment of loans?

Perhaps these, and other larger structural challenges and institutional reforms, will be addressed by the prime minister and his cabinet in the tabling of the 2024 budget.

In the meantime, I am cautiously optimistic that more policy announcements will be forthcoming after this unity government has crossed the hurdle of re-tabling the 2023 budget. – The Vibes, March 1, 2023

Ong Kian Ming is a programme director (philosophy, politics and economics) at Taylors University and former Bangi MP