KUALA LUMPUR – Maybank will continue to play a critical role in supporting small businesses and expects to disburse about RM12 billion in financing to small and medium enterprises (SMEs) this year.

Group president and chief executive officer Datuk Khairussaleh Ramli said Maybank has been facilitative in assisting its borrowers, especially low-income households and small businesses who are in need of repayment assistance for various reasons.

“Since the pandemic, Maybank has provided repayment assistance to more than 430,000 borrowers in Malaysia.

“Currently, Maybank has about 52,000 borrowers that have been provided with different forms of active repayment assistance,” he said.

Yesterday, Prime Minister Datuk Seri Anwar Ibrahim called on banks to continue to offer loan repayment assistance to individuals and SMEs in need, including assistance in scheduling and restructuring their loans.

Anwar, who is also finance minister, also reminded the banking industry that they play an important role in driving post-pandemic economic growth, especially in helping borrowers who are still affected and have difficulty moving on with their lives.

Khairussaleh said Maybank has fully supported the government’s efforts toward ensuring a healthy and stable economic environment for businesses and individuals to thrive.

He noted that Maybank will remain steadfast in supporting its customers and clients by leveraging on its deep financial services expertise, which is enhanced by digital capabilities.

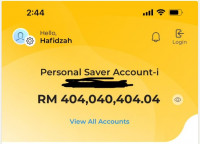

“Our digital platforms are currently serving multiple customer segments, ranging from institutional corporates, SMEs to retail consumers, and we will continue to prioritise these segments in our efforts to grow our footprint across Asean,” he added. – Bernama, July 1, 2023