KUALA LUMPUR – American founding father Benjamin Franklin once said: “In this world, nothing is certain except death and taxes.”

With this in mind, Malaysians can anticipate new taxations or increased rates of current tax regimes in Budget 2022 to be announced tomorrow.

After all, the government will have to raise more revenue to offset the increased spending to rebuild the country’s economy.

But in the short term, this may not be the case as the government focuses on getting Malaysians back on their feet.

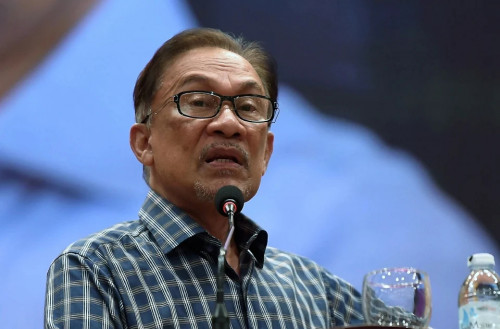

Deloitte Malaysia executive director for indirect tax Senthuran Elalingam said that the firm does not anticipate any significant announcement like the implementation of the goods and services tax in the upcoming budget.

“The government’s focus in the short-term is likely to be on encouraging and increasing consumption to re-energise the economy post-lockdown,” he said.

Senthuran expects an extension to the concessions provided to the tourism and motor industry.

“We anticipate that such measures would encourage consumption and consumer spending and help support these industries during the recovery period.

“In terms of tourism, there was a recent narrowing of the service tax exemption for hotels and hotel operators by limiting it to only hotel rooms and imposing service tax on non-accommodation services such as meals and laundry.

“We are of the view that a reinstatement of the position where all such services provided within the accommodation premises are exempt from service tax would provide further encouragement to tourists.”

Senthuran also does not anticipate an increase in excise duties in relation to alcohol and tobacco, popularly known as sin tax, in Budget 2022.

“Additional taxes or duties, in our view, would create a dampening effect on consumption.”

For Budget 2022, the government is expected to allocate a total sum of RM348.3 billion, which is 10.6% higher than the revised RM314.8 billion in 2021.

The increase is underpinned by an expected RM83 billion spending on development expenditure, which is much higher than the RM68.2 billion in 2021, to drive socio-economic recovery activities and the nation’s development agenda.

To increase the expendable income of individuals and households in the M40 group, Deloitte Malaysia executive director for global employer services Chee Ying Cheng said the government should consider reducing the tax for the chargeable income range of between RM70,001 and RM100,000.

This covers a larger population of the M40 income group, whose income range is between RM4,850 and RM10,959.

“Alternatively, it would be to broaden the income brackets and reduce taxable income bands,” said Chee, adding that the individual tax rate was reduced by 1% for chargeable income bands above RM50,000 to RM70,000 in Budget 2021.

She also proposed that the government consider the following:

- Reintroducing a one-off special tax relief similar to year of assessment 2015

- Extending the retirement incentive (i-Saraan) under the Employees Provident Fund beyond 2022 for self-employed individuals

- Providing SMEs or small business grants to individuals who have lost their jobs and are seeking to start their own businesses

From the rakyat’s perspective, Chee said that the government could consider introducing certain tax measures to reduce the tax burden. Some incentives that can be considered include:

- Tax relief for expenses incurred during the pandemic such as face masks, Covid-19 self-test kits, and hand sanitisers

- Tax exemptions on employee allowances or benefits received where employers provided financial aid to employees or their family members on costs of Covid-19 treatment and medical supplies for virus prevention purposes

- With many individuals still working from home full-time or on a rotational basis, considerations to allow direct expenses incurred (e.g. electricity), to be claimable as tax relief or as deduction. Similar deductions are allowed in Australia, based on a predetermined hourly rate, applied to work-from-home hours

- Widening the life insurance tax relief coverage to allow parents to claim insurance purchased for their children. Currently the relief is only given to the taxpayer and spouse.

Shore up core of economy

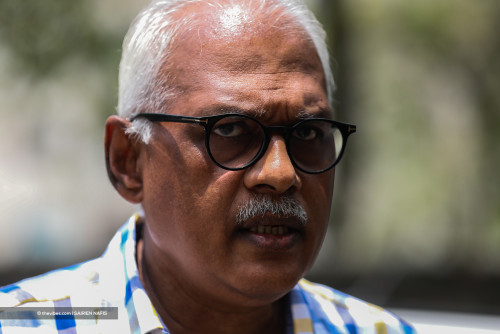

Mark Chan, Deloitte Malaysia’s financial services industry tax leader said that Budget 2022 should focus on getting the core of the economy, namely the small and medium enterprises (SMEs), and the B40 and M40 groups back online.

“Tax incentives may not be of much help if they are geared towards giving tax shelters when people have no income to tax in the first place.

“Deferring tax shields like losses and allowances for future claims are nice to have but do not address the issue at hand, which is how to revive the economy that has been so badly hit and give the people a lifeline,” said Chan.

He also said that the budget should provide low-cost lending and financial assistance by way of grants to targeted sectors such as food and beverages, tourism, retail, and hospitality, which will in turn channel the funding to the rakyat by way of employment.

“This will in turn give the people more spending power to support the businesses.

“Strong and firm action must also be taken to review the spending of ministries and government bodies to curb potential wastage as tax revenue is on the decline.”

Chan called on the government to expedite the repayment of tax refunds which many businesses have been awaiting from more than three years ago.

He outlined tax incentives that the government can consider, which include:

- Grants or loans that match capital invested by business owners to provide temporary funding which will be recoverable

- Extension of accelerated capital allowance incentives to allow businesses to renew their capital assets and recover tax shelters faster

- Grants or tax shelters to support SMEs going digital

- Double deductions for employers who hire retirees and people who have been unemployed for more than six months

On calls to extend the moratorium period for businesses and individuals, Chan said the government should encourage financial institutions to consider moratoriums on a case-by-case basis, particularly for businesses and individuals who demonstrate genuine hardship and potential to repay.

“Enforcing a prolonged moratorium is not realistic as it will impair the flow of capital in the country to other businesses and individuals who need the capital,” he said.

“Perhaps a compromise should be proposed, where the interest portion is rebated to the borrower to reduce the cost of borrowing and still allow the financial institutions to recover the capital.” – The Vibes, October 28, 2021