THERE is a well-known proverb in the Malay language that goes “Sediakan payung sebelum hujan” which in direct translation means to prepare an umbrella before it rains. Often quoted as a reminder of the need for prudent preparation before facing challenges, this proverb also highlights the significance of saving for rainy days.

This underlying principle magnifies the crucial role that Malaysia’s Employees Provident Fund (EPF) plays in helping create a better retirement for the Malaysian workforce.

Recently on March 2, EPF announced that a whopping 48% of EPF members have less than RM10,000 in their accounts, accounting for the RM101 billion pandemic-related i-Lestari, iSinar and i-Citra withdrawals.

Most worryingly, the savings of the bottom 40% of EPF members fell by 38% to just RM8 billion, which renders a median savings balance of RM1,005. In other words, the umbrella meant to safeguard retirement savings is now full of holes, or in some cases completely broken.

Notably, the withdrawal schemes during the pandemic have temporarily alleviated the financial burdens of those who have lost their jobs and are experiencing cashflow problems. As a stopgap measure during unprecedented times in addition to other government initiatives, many Malaysians benefitted from these schemes.

However, the repeated withdrawals to face the seemingly endless cycles of rainy days is turning into a ticking time bomb. Hence, the government’s latest decision to allow another special RM10,000 withdrawal is extremely worrying.

Was this decision driven by sound economic reasoning or political motives? How much more will this additional withdrawal deplete the savings of financially vulnerable households?

Furthermore, many of the most vulnerable might be disqualified from making another round of withdrawals, considering their account balance. Even if their applications were approved, another withdrawal will result in the loss of annual and compounded dividends, in the long run, further depleting the long-term savings of the most vulnerable from low-income communities.

This was the case in the most recent 6.1% dividend announcement, whereby the majority with minimal savings left could not benefit much from the highest dividend payment since 2017 when EPF declared a 6.9% dividend.

Repeated withdrawals will only lead to shrinking capital, jeopardising the ability of EPF to generate income and better dividends for a brighter future. In the long run, Malaysia will face an uphill task of addressing old-age poverty and the financial vulnerability of households in an ageing society.

From the onset, EPF’s mission and vision are to help members achieve a better future through continuous improvement in safeguarding members’ savings and delivering excellent services.

Thus, the repeated withdrawals do not align with the raison d'être of the retirement scheme. In short, EPF is never meant to be an emergency relief fund. Instead, we strongly need to reinforce EPF’s position as a trustworthy provident fund and dependable trustee to members’ retirement future.

Moreover, we call upon the government to proactively expand the various forms of financial aid to individuals and businesses to recover from the impact of the prolonged pandemic in the immediate term, instead of caving in to the demands for Malaysians to dip into their retirement funds.

Looking beyond EPF, we hope that the 12th Malaysian Plan will live up to its endeavour by prioritising people’s welfare and social protection. What’s crucial now and beyond is to reduce our population’s exposure to risk. This will help enhance their capacity to not only protect themselves from low retirement savings, but also against unforeseen interruption of income.

In other words, income security in a post-working age should be the core emphasis as we are living in an ageing population.

In the long term, we also need to reevaluate and reform the coverage of social protection measures for communities across Malaysia to effectively address vulnerability to poverty. – The Vibes, March 17, 2022

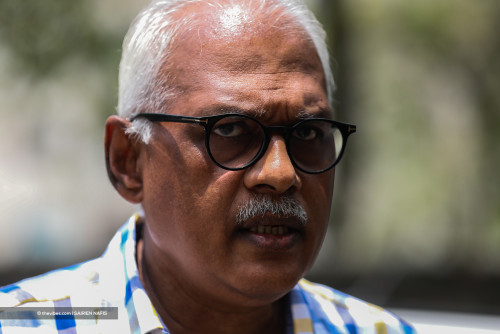

Benedict Weerasena is research director and Abel Benjamin Lim is the head of Development Economics of Bait Al Amanah