THE idea of having an Asian Monetary Fund (AMF) was proposed during the 1997 Asian financial crisis, which upset Asia’s continuously decades-long robust economic growth almost overnight. Nonetheless, the AMF did not get any support from the US-dominated International Monetary Fund and World Bank.

Its aims were far-sighted to stabilise the Asian currencies which would be beneficial to the more vulnerable developing countries and newly emerging industrial economies. In fact it would create a more stable and vibrant world economic order, but it was almost impossible to be realised without certain economic superpowers’ blessings, especially the United States and European Union at that material time.

As being the only two Asian members of the Organisation for Economic Co-operation and Development, Japan and South Korea were also the victims of the Asian financial crisis who wanted to establish AMF, but eventually backed down in the midst of America’s dominance in the IMF.

However, the global economy and financial structure have evolved drastically since then, especially with the setup of BRICS (Brazil-Russia-India-China-South Africa) and the call for “de-dollarisation”, the US and the West have to adjust and adapt to the new scenarios so as to come to terms with a mutually beneficial solution. The IMF imposed strict austerity measures to bail out Asian countries such as South Korea, Thailand, and Indonesia in the 1997 Asian financial crisis.

These stringent austerity measures might be seen as unempathetic towards other underdeveloped countries, which have contrastingly diverse political cultures and socio-economic needs. And hence the AMF is to be tailored with the specific cultural and social needs of each Asian country, especially with the support of rising economic powers like China, Japan, South Korea, India, Middle Eastern countries, and Asean, which are newly emerging industrial economies.

Similar to the Asian Infrastructure Investment Bank (AIIB) proposed by and set up in China, in which the US and other EU countries have also invested, the AMF needs the investments and cooperation not only from the Asian economic giants but also the US and EU in order to make it a successful financial institution.

Its creation would be of mutual economic and political interests for both Asia and the West to help stabilise various currencies of the newly emerging economies and fairer competition in global trades, which would also in turn stabilise the volatile post-pandemic political moods around the world and advance the world economy to another level of progressive economic growth. Not only Asia. On the other hand, the US and the EU would also stand to lose out more economic interest if they fail to foresee the necessity to cooperate with the newly emerging economies and forge a new order in socioeconomic development.

‘Them Belly Full’: a hungry mob is an angry mob

The AMF is seen to be one of many efforts to make sure that Asia and the world would progress together. Or else, not only other less developed countries, the advanced countries like the US and EU would themselves face more abrupt social upheavals in their own home grounds if countries failed to cooperate and address the basic bread-and-butter issues globally. Economic instability could often be caused due to political sabotages by means of destabilising a country’s currency.

It has long been evident in toppling any government by causing direct economic hardships to her people. Evidently a people loses out her purchasing powers and she would be slapped with hyperinflations when her currency is rapidly being devalued against major foreign currencies especially the most dominant greenbacks.

Beyond any sophisticated political theories, the renowned reggae singer Bob Marley concluded it well in his “Them Belly Full”, which resonates a simple but politically sound message “A hungry mob is a(n) angry mob”. Undermining a country’s currency could result in skyrocketing hyperinflation leading to disruptions in food and basic necessities’ supply that would bring about abrupt social upheavals in especially economically and politically vulnerable developing countries. It is often the economic interest of the developed nations to ensure their hegemony over the world markets and economies by manipulating the values of the currencies around the world that decide each people’s purchasing powers and the value of their possessions.

When many more newly emerging regional economic powers rise up, the same old formula needs to be restructured, reformed, and refined. Asia, like other regions such as Latin America and Africa, regional economic leading powers, are rising. The Western powers have to adjust and adapt themselves to the new realities. Non-cooperation and sanctions upon newly emerging regional economic powers are not in the best interest of a peaceful and workable world order, but it is also potentially detrimental to the advanced nations’ economies resulting in social unrest in their yards.

Anwar’s meticulously cautious proposal on AMF

In recent months, Malaysian Prime Minister Datuk Seri Anwar Ibrahim proposed that, besides the US dollar, the Chinese Ren Min Bi would be also pegged to the AMF. Nonetheless, other regional currencies such as the Singaporean dollar, Swiss Franc, Euro are substantially stable and competitive, and they could also be used for similar purposes. I believe the purpose of his idea is not to confront the US and the Western world, but it is to remind everyone of a new reality that there are many emerging economies in the world, including China, SEA, and that a more equitable and stable financial system is desired rather than a single monetary system which is often disproportionate to the actual productivity of any country and the actual value of a currency.

The AMF is similar to BRICS in an attempt to trade in individual local currencies than the US dollar, but it is dissimilar to BRICS in the way that it is aimed to have much more consistent systemic management of fiscal policies in the region to be less affected by the US and Western markets risks. It is more vital and effective in keeping harmony and peace in the region than BRICS. Nonetheless, Japan and South Korea would not have gone ahead with the idea without the US’ consensus due to their reliance on the US market for their exports.

Not only for political reasons, foreign exchange has also long been unscrupulously speculated for individual players’ own profits rather than long term investment that would improve the productivity and quality of life of the general populations. In this respect, the developing countries’ currencies are most vulnerable to fluctuation of their currencies’ value. It is also a system in which the superpowers could manipulate the world economy to their own benefits at the expense of the poorer and smaller countries. The AMF was proposed in an effort to make the world financial system more competitive and break the monopoly of a single currency in any free market economy because any form of hegemony would tamper its competitiveness and the meaning of free trade.

The Labuan Bajo Declaration

Nonetheless, stabilising regional Asian currencies is the major objective of having a joint Asian monetary institution and the local purchasing powers within the region in relation to the world at large. Smaller countries with smaller economies have been extremely vulnerable to a volatile free market and fluidity of the foreign currency speculations, unless they are coordinated well in solidarity. Therefore, it is important for any country to prioritise regional solidarity from political and economic cooperation to monetary and financial integration. This is to ensure national and regional political stability and economic growth. ASEAN’s recent Labuan Bajo Declaration on “Advancing Regional Payment Connectivity and Promoting Local Currency Transaction” is going towards a more unified Asean and Asian monetary policy that is essential for advancing Asian economies and democracy.

The Asean countries have a total nearly 700 million population, and account for 7% of global GDP and 9% of global GDP growth in the past 10 years. Its share of the global economy is expected to grow larger, and it could act as an effective negotiation bloc at the world stage. Therefore, the Labuan Bajo Declaration is fundamental for any Asean country to promote AMF in the future, which would only be closer to reality if Asean speaks with one voice.

The IMF has been dominated by mainly the US and other Western countries while most Asian countries are still underdeveloped and medium income countries. It is a genuine complaint that the IMF has been less empathetic towards these countries, which are also plagued by the essential problems of underdeveloped infrastructure and corruption. Not only the AMF but also the renaissance of Asian culture, revival of good governance is essential to move Asia and the world forward and beyond. The IMF, the US and EU should be prepared to participate in any efforts of establishing the AMF or any other regional monetary funds than undermining the already-weak fundamentals of many Asian countries for their own short-term gains. On the contrary, investing in any other proposed regional monetary funds, such as the AMF, would bring about a win-win solution and mutual benefits to both Asia and the West, similar to the fact that the US and The West have invested in the China-proposed AIIB.

From Asean+3 to AMF

The Asian Financial Crisis in 1997 exposed the weaknesses of the respective financial systems in most Asian countries and the vulnerability of their economies. They need to buck up in reforming not only their financial system but also iron out the intrinsic problem of rampant corruption in both public and private sectors. Asian countries including China, India, and Malaysia top the world in terms of illicit capital outflows. This has caused a vicious cycle at which fragile and less transparent financial systems create huge loopholes for businesses to evade taxes, and corrupt public figures to deposit their money offshore, mainly in US dollars and other OECD member states.

Certainly, the AMF would ensure more predictable and stable Asian currencies that would make international trade more predictably profitable and improve the purchasing powers of their countrymen proportionately in relation to their productivity within the region. Asean’s Labuan Bajo Declaration is a positive move to reassure the usage of the local currencies and their respective demands and values rather than going through a third currency, be it the USD, Euro or RMB. Asean’s regional solidarity is crucial in advancing Asean member states politically and socio-economically. The Labuan Bajo Declaration would help stabilise and promote trades within the region. On the other hand, Asean has to act en bloc in terms of negotiations with other larger economies in Asia such as China, Japan, South Korea and Middle Eastern oil states to form closer ties as trading partners or forming a unifying monetary institution such as AMF. This would realise another greater period of economic growth and political advancement for Asian countries as a whole.

Singapore has a tight fiscal and monetary policy under the watch of its Monetary Authority of Singapore (MAS), and ASEAN+3 Macroeconomic Research Office was set up in Singapore in 2011. With the Labuan Bajo Declaration. ASEAN + 3 (China, Japan and South Korea) should be looking forward to a much closer socio-economic cooperation and monetary integration. The AMF could be based on a much closer relationship between ASEAN+3 AMRO from policy research and advisory body to a fiscal mechanism implementation institution.

A more efficient regulatory mechanism like the AMF on the Asian currencies would ensure stability in regional currencies and hence more predictable trades, enhance transparency in intra-regional transnational transactions and contain illicit capital outflows that have adversely affected development in many member states. Usage of local currencies and easier regional direct transactions system would stimulate regional trades and economies by making trades and businesses more transparent and containing illicit capital outflows. On the other hand, from ASEAN+3 AMRO to AMF, this would ensure financial stability, more robust regional economic growth, more manageable inflations and hence sustaining the purchasing powers of their respective populaces and secure much greater collective reserves to absorb shocks from global recessions and fiscal disasters. – The Vibes, August 6, 2023

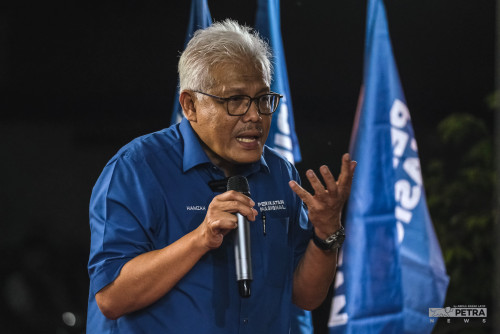

Dr Boo Cheng Hau is the former Johor DAP chairman and a former Johor assemblyman

_and_lord_mayor_rajendran_posing_in_a_mock_up_lrt-Ian_pic.jpeg)

.jpeg)