KUALA LUMPUR – The Federation of Malaysian Manufacturers (FMM) welcomed the reintroduction of the goods and services tax (GST) as a further means to increase government revenue and spur better economic recovery.

In a statement today, FMM president Tan Sri Soh Thian Lai said the GST is a more fair and transparent tax regime compared to the sales and service tax (SST).

"Based on a survey carried out by FMM on the reintroduction of GST in May 2020, a total of 499 companies which responded to the survey strongly supported having the GST replace the current SST 2.0 as the GST provides a fairer tax structure and eliminates the cascading and compounding of taxes commonly found in the SST regime.

"In addition, prices of Malaysian exports will become more competitive on the global stage as no GST is imposed on exported goods and services, while GST incurred on inputs can be recovered along the supply chain.

“Moreover, because this broad tax base system would increase indirect taxes, it will give flexibility to the government to reduce direct taxes (personal income tax and corporate tax) to make Malaysia a more attractive business destination,” he said.

Soh suggested that the implementation of the GST be done at a 4% rate while corporate tax be reduced to 20%.

Similarly, the government should zero-rate all essential goods and services, set the GST registration threshold at RM500,000, and minimise delays in refunds, especially for exporters and businesses with zero-rated supplies.

The government should also include the provision of interest on late payments and refunds in the GST legislation to ensure strict compliance with the client charter and the integrity of the system, suggested Soh.

Moreover, the government should also create more efficient schemes to replace the Approved Trader Scheme and Approved Toll Manufacturing Scheme as they are complicated and difficult to implement.

Lastly, Soh suggested that the government ensure a proper mechanism to monitor price control and anti-profiteering in the market when the tax system is reintroduced.

However, FMM acknowledged that the possible transition to the GST tax regime can be challenging and urged that all stakeholders be consulted for a thorough review process to ensure the success of introducing an effective tax regime.

The GST was introduced by the Barisan Nasional government in April 2015 at a standard rate of 6%.

It was terminated when Pakatan Harapan (PH) took over the government following the general election of May 2018.

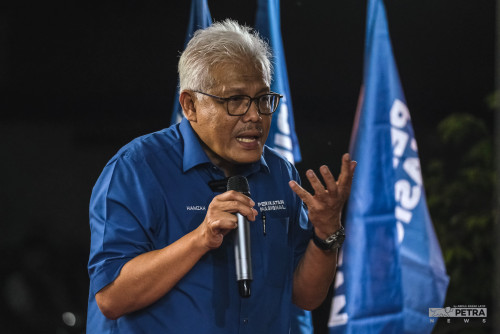

Yesterday, the PH presidential council rejected Prime Minister Datuk Seri Ismail Sabri Yaakob’s proposal to reintroduce the GST.

Ismail Sabri had said in an interview with Nikkei Asia in Tokyo that no other nation besides Malaysia has reverted from the GST to SST.

The prime minister said the nation lost RM20 billion in annual revenue after the GST was abolished and replaced with the SST. – The Vibes, June 2, 2022

_and_lord_mayor_rajendran_posing_in_a_mock_up_lrt-Ian_pic.jpeg)