KUALA LUMPUR – Employees Provident Fund (EPF) contributors could have enjoyed much higher dividends had it not been for the withdrawals made by millions of Malaysians during the pandemic period, the Dewan Rakyat heard.

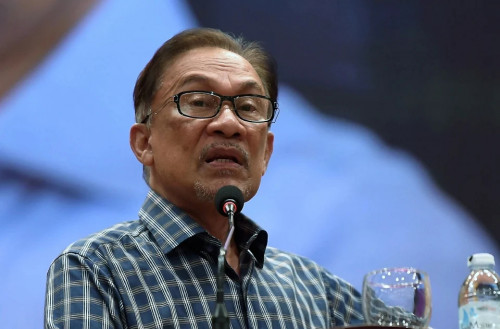

Finance Minister Datuk Seri Tengku Zafrul Tengku Abdul Aziz said that rather than the 6.1% dividend for conventional savings declared earlier this month for the year 2021, this figure could have instead reached up to 6.7%.

He said this amounted to RM5.4 billion in additional dividends that should have reached the hands of the contributors.

“This loss of RM5.4 billion has forced 5.3 million EPF members who had never withdrawn their savings through any of the previous schemes to accept much lower returns.

“I would like to ask all the honorary members of this House, do you feel this is fair?” he said in his winding up speech at the royal address today.

According to Tengku Zafrul, the i-Lestari, i-Sinar and i-Citra schemes in 2020 and 2021 had seen 7.3 million members (or 58% of all contributors) benefitting from them, with a staggering RM101 billion withdrawn during this period.

Due to this, he said 6.1 million members (48%) aged below 55 only have savings of less than RM10,000.

The minister was responding to calls from lawmakers to allow EPF members to make further withdrawals of up to RM10,000 to assist them in their finances.

Tengku Zafrul said if the government was to allow this, this could involve an additional withdrawal of at least RM63 billion, with 6.3 million contributors expected to make use of the programme.

“EPF will then have to implement the rebalancing of portfolios, and the impact is likely to be more than RM63 billion.”

The senator explained that for EPF to prepare such an amount, it may be forced to sell more foreign assets in a volatile market, as well as cease short and medium-term domestic investments.

Such a measure will continue to negatively impact the stock market and domestic bonds, he added. – The Vibes, March 14, 2022