A RM50 BILLION injection of aid by giving cash to the most needy sections of society and an RM2 billion immediate injection to help hospitals in the Klang Valley cope with large numbers of Covid-19 cases are probably the most urgent things to do now.

This will alleviate the needless suffering of large numbers of people in the current environment who have to literally beg for food by flying white flags and rely on volunteers and non-governmental organisation to help them while the government should be at the forefront of such efforts.

But how would the government raise that RM52 billion, you ask.

It can be done through multipartisan efforts by political units to raise the debt ceiling. And this can be done by calling for an urgent meeting of Parliament. But first, let’s lay out the problems and solutions.

There are two major urgent, overdue problems relating to the current Covid-19 pandemic, which has been raging out of control as never before and reaching record numbers day by day.

First, many people are being deprived of food because incomes have ceased or are severely crimped. Second, hospital services are in dire need, especially in the Klang Valley where cases in Selangor and Kuala Lumpur have exploded, accounting for some 60% of new daily infections.

Before we go on to other things, let us address these two first, which are resource constraints that can be resolved by mobilising money and putting it into the hands of the most seriously affected and ensure sufficient supply of beds, devices and medicines in hospitals as cases rise.

The problem with our aid scheme is that much of it is targeted to the business sector instead of the flesh-and-blood people who are most affected. According to our Statistics Department, as of February 12, 2021, a total of RM12.76 billion was distributed through the Wage Subsidy Programme (PSU 1.0), covering 2.64 million registered employees from 322,177 employers.

Subsequently, for PSU 2.0, a total of RM770.31 million had been distributed to 65,398 employers for 534,183 employees to help businesses maintain operations and retain workers.

That means at maximum a total of 3.17 million jobs were protected by giving 388,000 employers some RM13 billion, or RM33,500 per employer/RM4,100 per employee.

In practice, even if the employer can afford to pay their employees, they got the subsidy. This is an enormous waste of limited funds, channelling resources to the wrong company/person with no check and balance to see if they deserved it. Remember, this is blanket aid.

And then contrast it with this: Bernama quoted Finance Minister Datuk Seri Tengku Zafrul Tengku Abdul Aziz as saying the government had paid out RM4.6 billion to a total of 8.4 million Bantuan Prihatin Rakyat (BPR) recipients from the B40 segment in February, March and May this year, adding that payments under Phase 3 of the initiative will be made in September.

That’s just RM550 per person against RM4,100 per employee and RM33,500 per employer under the other programme. This is just not right, because the people who are suffering the most are not businesses or those already in employment, but those who have lost their jobs and casual workers who can’t earn a living.

Business owners are generally much richer than the man on the street and typically have far more resources and savings than the poor. But Prime Minister Tan Sri Muhyiddin Yassin’s plan gave more to the rich and less to the poor – way too little, in fact.

And then they induced the poor to take out their savings in the Employees Provident Fund (EPF) even if they did not need it and to stop paying their bank loans even if they had the means of paying them, using their limited savings to stimulate the economy.

In our plan for the government to raise RM52 billion, RM50 billion will go directly to the B40 group in cash through bank accounts and RM2 billion for government hospitals to get badly needed beds, equipment and supplies. This will require Parliament sitting to pass, and therefore multipartisan support from all parties represented in the august House.

The finance minister has said there are 8.6 million BPR recipients. Let’s include others such as foreign workers to take the figure up to 10 million but ensure they are all in that income group. Give them all RM1,000 per month from August until the end of the year; RM5,000 in total. That will ensure everyone gets fed. The total for 10 million will be RM50 billion.

It will also be an economic stimulus for you can be sure the money gets spent instead of giving it to fat cat business owners who are more likely to ‘sorok’ it away instead of spending it. In the meantime, hospitals will get money to re-equip themselves.

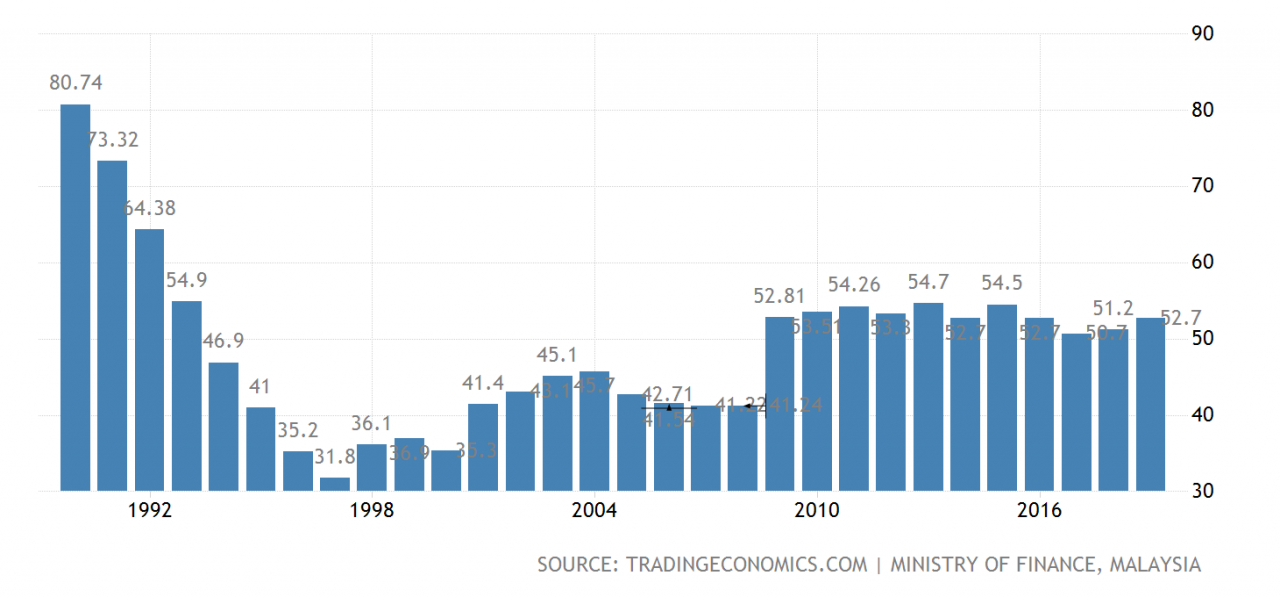

Here’s how to finance through borrowings. According to the Economic Outlook 2021 report by the Treasury, Malaysia’s debt at the end of 2020 was RM875 billion, 60.7% of the RM1.44 trillion nominal GDP in 2020, the total output of goods and services in a year at current prices. This already exceeds the parliamentary ceiling imposed at 60%.The plan is to increase the ceiling to 70%, which can be done via parliamentary sitting. Given a projected nominal GDP of RM1.57 trillion this year, the amount that the government can borrow is 10% of that or RM157 billion. We are talking about a figure of around just a third of that at RM52 billion.

Malaysia – government debt as a percentage of GDP

This is not as drastic as one may think. The chart below shows that our national debt has been as high as over 80% before and it is common for many countries even right now to have a ratio which is 70% or higher. The situation certainly warrants such a move right now. Provided the money is used only for these purposes, the rating agencies are likely to look at the move favourably.

At end-May 2021, banks had loaned out RM1.81 trillion, but had deposits of RM2.1 trillion. The excess of deposits over loans is RM290 billion. That means the entire RM52 billion in borrowings can be easily financed internally in ringgit, keeping risks low.

The government can issue bonds in stages over five months – RM12 billion for the first tranche and RM10 billion each for the remaining four tranches to make RM52 billion to match with the anticipated drawdowns.

Structure the bond such that individuals can buy small amounts through their banks. Those who are earning about 1% in fixed deposits can earn perhaps 3% from the bonds and you can rest assured there will be plenty of demand for the bond.

How about it, finance minister? You can propose it if you want. You are a banker and a finance man, you know it will work. Why don’t you take it to the PM?

But, all our politicians and especially MPs will have to put aside their differences to do this. Let’s have a moratorium on politicking – which means all must undertake not to pass no-confidence motions for the time being – not so difficult, right?

And then the necessary resolutions are tabled to raise the debt ceiling and the necessary RM52 billion with strict conditions that the money is to be distributed to the B40 group through the BPR scheme in cash, to the hospitals to get additional beds, etc.

That will give the B40 group enough money to ensure they have food on the table, the hospitals to obtain a reprieve from crowded conditions, and for everyone to buy time until the effects of double-dose vaccination take effect at the end of the year. In the meantime, lift controls and target them as the situation improves.

Now, if only the politicians will bury their hatchets, put on their thinking caps and for once look towards the welfare of the people and the country. That’s not so difficult, is it?

Who knows what the limit is if we can pull this off and cooperate to fight the pandemic, rather than be in a constant state of strife in a futile attempt to gain power. – The Vibes, July 13, 2021

P. Gunasegaram says the need for a few good men now has increased by leaps and bounds and holds some optimism for some of them to step forward. He is chief executive of research and advocacy organisation Sekhar Institute and editorial consultant of The Vibes