THE problem with beleaguered Prime Minister Tan Sri Muhyiddin Yassin’s so-called “Pemulih” is much the same as his first stimulus package announced in March last year – a lot of bluster and little substance, using the people’s own money and deferment of loan payments to stimulate the economy.

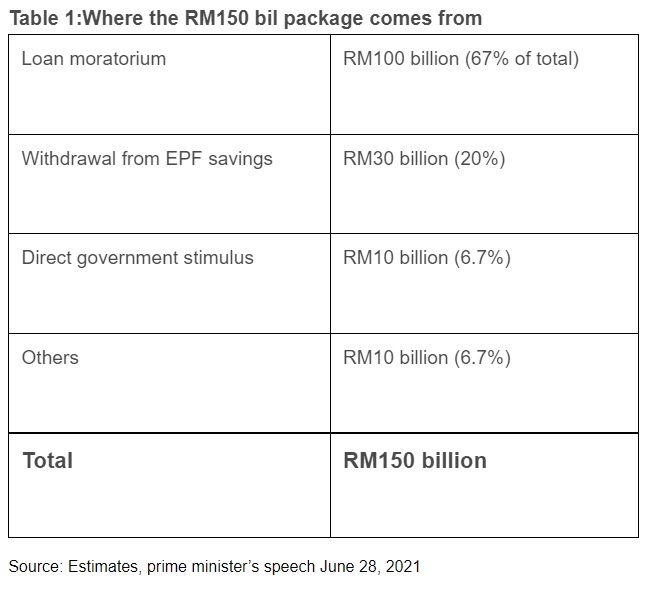

Despite the touted RM150 billion value of Pemulih, the direct fiscal injection is just RM10 billion, out of which about half is for the poor B40 group, far too little in a period where the lockdown has resulted in casual workers’ incomes being reduced to next to nothing and millions of families unable to buy adequate food.

The other RM140 billion of Pemulih is basically the effects of the moratorium on loans for a further six months, withdrawals of money from the Employees Provident Fund (EPF) amounting to RM30 billion, and other reliefs and subsidies. This is retirement money that the poor are spending now – their own money because this backdoor government can’t provide for them.

As if that was not bad enough, Muhyiddin’s Pemulih splits the meagre amounts being paid out with some payments coming in September, November and December, when the money is needed now.

This is clearly designed to first prolong the emergency (Muhyiddin said we won’t move to Phase 2 relaxations unless numbers drop below 4,000 infections per day – when infections moved up to more than 9,000 daily a month ago, he kept quiet). And, if and when Parliament is dissolved after September and elections take place after, he hopes that the people will be grateful for the money they receive then.

Under the Bantuan Prihatin Rakyat package or BPR, only RM500 per person will be paid to those eligible this month while between RM100 and RM1,400 per person will be paid in September and later, clearly backloading payments instead of front-loading them now, when it is needed. By September and after, many of those affected will be working and may not even need help then.

There is only one reason for doing something so illogical – to give the rakyat money closer to the time that elections will be held – the old “cash is king” strategy practised by one of his predecessors, Datuk Seri Najib Razak, who lost in 2018 despite those moves. Muhyiddin may well face the same fate, back-loaded cash assistance notwithstanding.

Muhyiddin expects the value of BPR payments to be some RM4.9 billion, with the remaining fiscal injection of some RM5.1 billion going to small businesses in the form of wage subsidies and other things.

You can read this article for an idea of where it all goes.

So, Muhyiddin’s stimulus Pemulih plan is not much of a stimulus programme because the government provides a hard cash injection of a mere RM10 billion, or 6.7% of the total – hardly enough to make a dent.

Table 1 shows where the Pemulih package derives its funds.

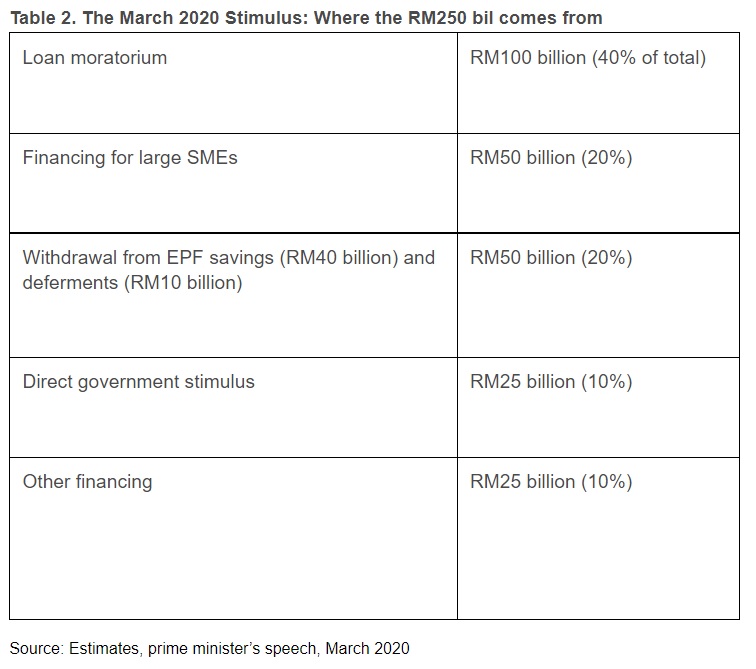

The loan moratorium itself, where repayments and interest payments are suspended for anyone who wants it for a period of six months, provides RM100 billion, according to our estimates. We get this figure from the previous RM250 billion programme (see Table 2).

That provides for a moratorium period of six months for bank loans, with the estimated impact being RM100 billion. While this may give succour in tough times by providing relief from payments, it is not a direct injection because people just stop paying their loan instalments.

But significantly, it reduces repayments to banks, which then have less to lend out to potential borrowers who have the means . This may have the actual effect of crimping the economy, opposite to the intended effect.

The insidious part is that, many who can afford to make payments now won’t because they don’t have to show that their incomes have been curtailed, leading them to spend the money unproductively and recklessly, and having to pay higher amounts later. This is especially true for the uninformed layman who wants to keep all the cash he can in tough times.

The thing to note is that, this large “stimulus” does not at all help the poor, almost all of whom are not likely to have any bank borrowings because of their subsistence existence, leading to a lopsided arrangement where those who can better protect themselves are given greater help.

Another particularly vicious element about Muhyiddin’s Pemulih is that, yet again, it relies on EPF money, which should be kept for retirement, to stimulate spending and alleviate the suffering of the poorer sections of the community.

The i-Citra programme allows any EPF member to withdraw up to RM5,000 from his EPF account, whether you need it or not, to be drawn down in five instalments. This affects 12.6 million EPF members and accounts for RM30 billion or 20% of Pemulih.

As a friend of mine said: the economy is on a giant ventilator called EPF. To that, I would add “loan moratorium”. Together, they make up 87% of Pemulih – a scam stimulus package! It is inducing us to use our precious retirement funds now and to defer our loan payments only to pay that back with extra interest later.

What should Muhyiddin have done? Sure, a loan moratorium is alright but only if you absolutely need it – let the banks be the judge of it instead of putting easy money into the hands of everyone. Ditto for the new EPF withdrawals.

But again, the abject failure of the Muhyiddin government is that it has not given enough money to the hardcore poor in sufficient amounts. Give them up to RM100 billion if necessary. But ensure it goes to the right people.

Of course, that would bust the government borrowing limit of 60% of gross domestic product – value of goods and services produced in a year. But there is a way around it.

You can go to Parliament and raise the limit, say to 70%, which will give sufficient leeway to the government to do it. Problem is, this government is afraid that it may not have a majority in Parliament.

Even that is not a problem if the government extends a genuine hand of cooperation to the opposition to fund the Covid-19 fight and ameliorate its impact on the economy together. But Muhyiddin neither has the magnanimity nor the vision to do such a thing. If he had done that in March last year, he would have had a grateful nation on his hands now instead of a griping one.

Which is yet another reason why he is not fit to be prime minister. – The Vibes, July 1, 2021

P. Gunasegaram is alarmed at the way the government is handling Covid-19, and so is much of the population. He is chief executive of research and advocacy unit Sekhar Institute and editorial consultant of The Vibes