KUALA LUMPUR – Businessman Tan Sri Desmond Lim Siew Choon is planning a takeover of the Subang airport, but key government-linked stakeholders are objecting the move, claiming estimated losses of up to RM11.9 billion, according to documents sighted by The Vibes.

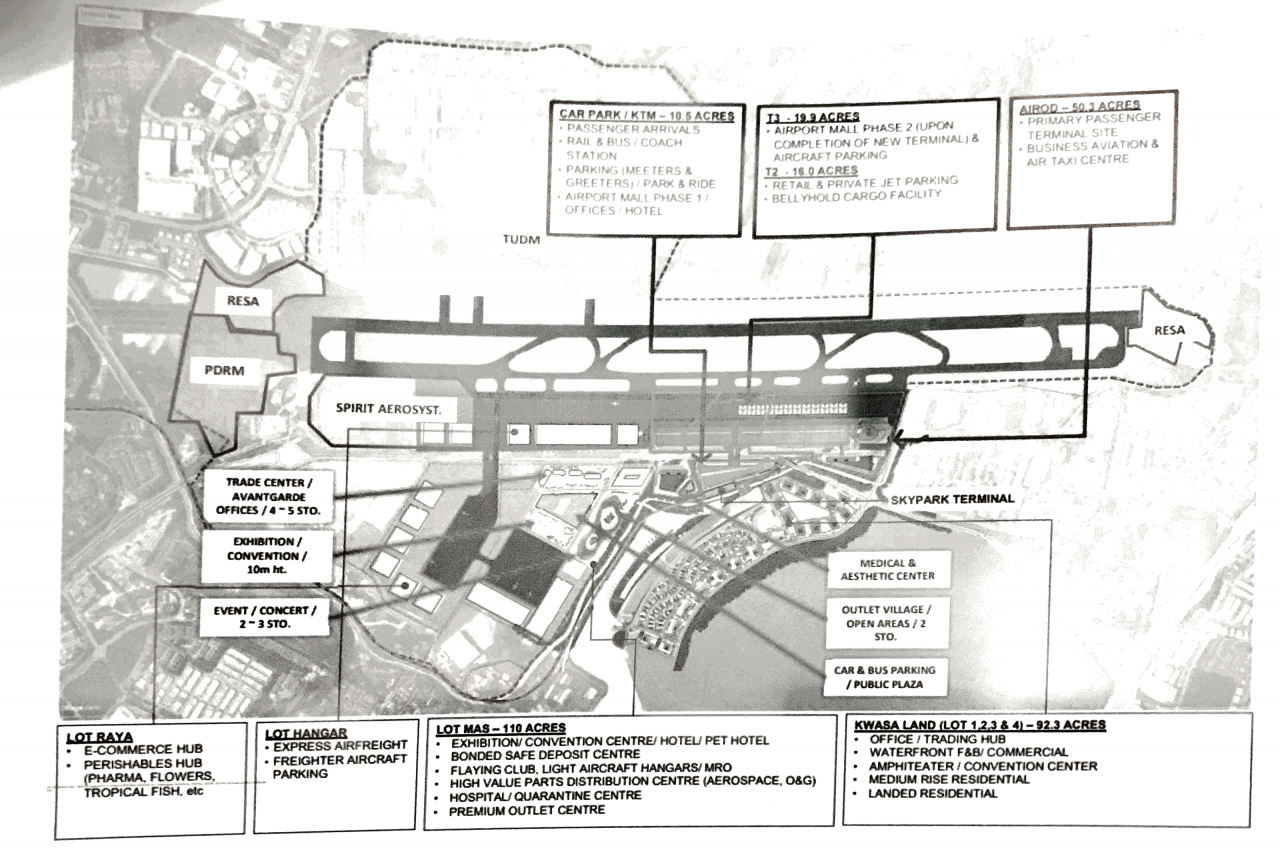

WCT Holdings Bhd’s wholly owned unit, Subang Skypark Sdn Bhd (SSSB), is proposing to enter a new concession to operate the entire Sultan Abdul Aziz Shah Airport area until 2092, developing it to be a city airport, read the concept papers.

Lim of Pavilion Kuala Lumpur fame has a direct stake of 7.3% and an indirect stake of 18.15% through vehicle Dominion Nexus Sdn Bhd in WCT Holdings. He is also the group’s executive chairman.

SSSB is believed to have made the proposal to the government via the Transport Ministry. Subang airport, the company said, will target point-to-point passengers and express freight, together with related property developments.

“It will grow to 7.5mppa (million passengers per annum) and will operate turboprops, small jets, helicopters, drone/air-taxis and freighters.”

SSSB is estimating a total of RM3.7 billion of initial investment without recourse to government funding. RM1.7 billion will be for the passenger terminal and executive jet terminal to open in 2027 while RM2 billion will be spent over the next 10 years in the airport city.

But the airport, the company said, would not compete with Kuala Lumpur International Airport (KLIA) as the focus will be “premium business travellers, capturing a different market from KLIA passengers”.

The plan would also be on developing routes to cities or complementary secondary airports currently not being served by KLIA such as Jakarta’s Halim Perdanakusuma International airport.

SSSB said it would have to negotiate “fair compensation” to owner Malaysia Airports Holdings Bhd (MAHB) and maintenance, repair and overhaul specialist Airod Sdn Bhd for vacating the airport.

But “other occupants will continue to use their facilities, including Khazanah, CAAM (control tower), PDRM (Royal Malaysia Police) and TUDM (Royal Malaysian Air Force)”.

Khazanah Nasional Bhd is MAHB’s controlling shareholder while CAAM is the acronym for regulator, Civil Aviation Authority of Malaysia.

SSSB added that it would be proposing sharing a portion of the airport landing charges, roughly 15%, as a concession fee payment to the government “in compensation for the use of the runway”.

MAHB, with Malaysia Aviation Group Bhd (MAG), the holding company of national flag carrier Malaysia Airlines Bhd, are in disagreement over the sale.

In an April 28 letter to the Transport Ministry Secretary-General Datuk Isham Ishak, MAHB chief executive Datuk Mohd Shukrie Mohd Salleh and MAG chief executive Izham Ismail said the sale could “significantly affect the country’s aviation industry”.

They said KLIA will lose its competitiveness to its regional peers while also threatening the investment returns of both companies’ owner Khazanah Nasional Bhd as well as institutional investors Permodalan Nasional Bhd, Employees Provident Fund and Retirement Fund Inc.

“The negative impact to both companies (MAHB and MAG) will certainly involve public money.”

The duo went on to list other effects such as financial impact to MAHB and MAG. For example, MAHB could default on its sukuk and will have to compensate bondholders up to RM3.8 billion while MAG subsidiaries MAB and Firefly could see their bottom lines affected.

More importantly, they said, MAHB stands to lose RM11.9 billion, based on the remainder of the Subang airport concession until 2069.

Cost includes the loss of revenue from the passenger services charge and various rentals and leases, among others, ultimately leading to a loss of investment returns for government-linked investment companies such as Khazanah and EPF.

Shukrie and Izham pleaded with the ministry and the government to then allow MAHB to execute its “Subang airport regeneration” which had been recently tabled to key public officials, including Transport Minister Datuk Seri Wee Ka Siong.

“MAHB is estimating that 80% of development works will be ready within five years.

“But MAHB is confident that a large portion of the plan can be executed within three years. Therefore, we plead that MAHB is given the chance to execute the Subang airport regeneration plan as planned.”

MAHB, too, would not require public funds as it has already set aside capital expenditure for the so-called regeneration project and “there are no additional terms seeking to extend the current concession beyond 2069”.

A Transport Ministry spokesman told The Vibes that the ministry “will not answer on this matter for now” while WCT said, as it is a publicly listed company, “we are to comply to the regulations set out by the Securities Commission. Hence, we will not be able to provide any forward looking statements”. MAHB has yet to respond at the time of writing. – The Vibes, May 6, 2021

.jpg)