KUALA LUMPUR – Malaysian Resources Corporation Bhd (MRCB) recorded revenue of RM742.2 million and a profit before tax of RM20.6 million in the first three months of 2023, compared to revenue of RM810.7 million and a profit before tax of RM31.8 million in the corresponding period in 2022.

While the lower performance was mainly due to a lower contribution from the Engineering, Construction and Environment Division as a result of the completion of key infrastructure projects in late 2022, it was partially offset by a much stronger performance from the Property Development and Investment Division.

The Property Development and Investment Division recorded a 44% increase in revenue to RM267.9 million and a 58% increase in operating profit to RM33.3 million in Q1 2023.

This was due to Sentral Suites, the division’s largest project, achieving 100% construction completion, and the TRIA 9 Seputeh and Alstonia projects achieving higher construction progress of 96% and 61% respectively.

The division sold RM85.1 million worth of properties in Q1 2023 and had unbilled property sales of RM220.3 million. The group’s investment holding in Sentral REIT and Sentral REIT Management Sdn Bhd contributed a combined profit after tax of RM2.0 million.

The Engineering, Construction and Environment Division recorded a 25% decrease in revenue to RM458.5 million and a 128% decrease in operating profit to RM7.2 million.

The lower revenue and operating profit were mainly due to the completion of the DASH Package CB2 and MRT 2 Package V210 infrastructure projects in late 2022.

The bulk of the division’s revenue was contributed by the LRT3 project, Muara Sg Pahang Phase 3 (Package 3) and the PR1MA Brickfields construction projects. As at March 31, the LRT3 project achieved physical construction progress of 84%.

The division’s long-term external client order book was RM26.4 billion as at March 31, while the unbilled portion was RM17 billion.

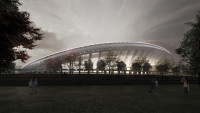

MRCB’s strategy to diversify its business into overseas markets continues to gather pace, and its 51-storey, 280 apartment residential development in Surfer’s Paradise in Gold Coast, Australia, named Vista, which has a gross development value of AUD391 million (RM1.2 billion) was launched on April 12 this year. – The Vibes, May 29, 2023