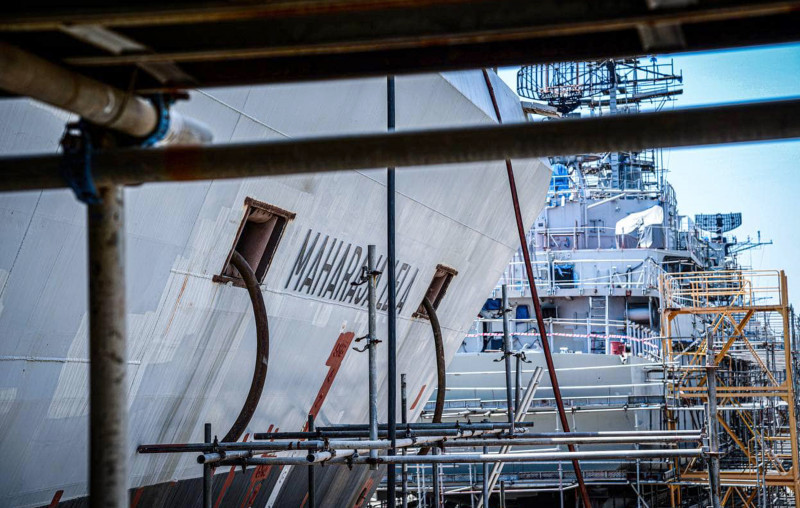

KUALA LUMPUR – Vessel provider Boustead Naval Shipyard Sdn Bhd (BNS) promised all of its rights and future income from the RM9.13 billion littoral combat ship (LCS) contract with the government as collateral to obtain a mammoth loan from a private bank.

This is according to Companies Commission of Malaysia (SSM) documents sighted by The Vibes, which highlight details of the company’s charges with financial institution Affin Hwang Investment Bank Bhd in March 2012.

While the documents do not spell out the total loan amount obtained by BNS or the maturity period for the loan, they reveal that the “properties” affected were valued at a whooping RM5.965 billion.

Company charges are the security given by a firm over some or all its assets to secure a loan from a lender or creditor.

The lender can then recover the loan through proceeds of the sale of those assets in the event of a default.

Among the properties affected by the charges are all of BNS’ “present and future rights, title, benefits and interests in and to all revenues, proceeds, receivables, retention, compensation, claims and other monies” arising from a letter of award (LoA) dated December 16, 2011.

The agreement is believed to be related to the LCS project as, on the same date, the Malaysian government had, through the Defence Ministry, issued an LoA to BNS appointing it as the project’s main contractor.

According to a document shared with The Vibes by Boustead Heavy Industries Corporation Bhd – which also has Boustead Holdings Bhd as parent company – the company charges had originally been valued at RM5.565 billion before being increased on March 19, 2019.

The RM400 million hike was attributed to “additionally securing the revolving credit facility under the shariah principle of murabahah via tawarruq arrangement” in the document.

Meanwhile, the SSM documents also state that Affin Hwang Investment Bank will be able to gain control of any other contract or agreement that BNS has made or plans to ink with the Defence Ministry and the government if the company fails to satisfy the loan.

The charges were created on March 19, 2012, about three months after the government issued the LoA.

Long-time dues paid with taxpayers’ money?

Besides the RM5.965 billion charges, four other charges were also recorded on the same date, with three valued at RM5.965 billion each while one amounted to RM50 million.

Properties affected include assets and proceeds “in relation to the project for the construction/supply of six second-generation patrol vessels with combatant capabilities for the Royal Malaysian Navy”.

This comes amid allegations that a substantial amount of the RM6.08 billion given by the government to BNS for the LCS project was instead used to repay bad debts involving the previous new generation patrol vessel (NGPV) project.

Kota Raja MP Mohamad Sabu had claimed last Friday that RM45 million was channelled to bail out Penang Shipbuilding and Construction-Naval Dockyard Sdn Bhd (PSC-ND), which was awarded the NGPV contract in 1998 before it was bought over by Boustead Holdings Bhd in 2005 and renamed to BNS the following year.

Mohamad was the defence minister from May 2018 to February 2020. His predecessor was Datuk Seri Ahmad Zahid Hamidi, who was in charge of the defence ministry during the time of the LCS contract.

Armed Forces Fund Board (LTAT) CEO Datuk Ahmad Nazim Abdul Rahman had also confirmed that money from the LCS contract was used to pay off PSC-ND’s debt.

In 2005, Public Accounts Committee (PAC) proceedings found that the NGPV project was poorly managed by contractors and the Defence Ministry, while the auditor-general’s report in 2006 stated that there were many weaknesses with the project as the government had failed to prioritise its own interests.

The Governance, Procurement and Finance Investigation Committee (JKSTUPKK) report, which was declassified yesterday, disclosed that BNS has poor financial capabilities and performance, and is expected to face serious issues in servicing loans amounting to nearly RM1 billion.

BNS recently came under scrutiny after the PAC released its report on the government’s procurement of the LCS on August 4, highlighting various discrepancies and alleged misconduct plaguing the project over the years.

Among its findings were that BNS’s financial position is weak and critical due to wrongdoing, abuse of power and flaws in financial management, with loans amounting up to RM956 million. – The Vibes, August 18, 2022

The report above is the third part of a series by The Vibes on the LCS scandal. The first and second parts can be read here and here.