KUALA LUMPUR – Malayan Banking Bhd (Maybank) posted a net profit of RM1.96 billion for the second quarter ended June 30, 2021, more than double the RM941.73 million recorded in the same period last year.

In a statement today, Southeast Asia’s fourth-largest bank by assets said its earnings improved as loans continued to grow, net interest margin expanded from a more cost-effective funding mix, and impairments came in lower from a year earlier.

However, revenue declined to RM11.34 billion versus RM11.79 billion previously.

The group recorded a steady growth in net operating income to RM6.17 billion for the quarter, up 9.3% on-year, while its net impairment losses fell to RM567.2 million from RM1.74 billion in the same period last year.

For the cumulative six-month period ended June 30, 2021, the group saw its net profit surging to RM4.35 billion from RM2.99 billion previously, while revenue slipped to RM23.56 billion from RM25.03 billion.

It also saw its net fee-based income easing 16.5% to RM3.50 billion from RM4.19 billion in the corresponding period in 2020, owing primarily to lower investment disposal gains and marked-to-market losses.

The Maybank board declared a first interim dividend of 28 sen per share to be made under its dividend reinvestment plan.

“This dividend comprises 14 sen per share to be paid in cash and an electable portion of 14 sen per share that can be reinvested into new ordinary shares or paid in cash.

“The dividend payout to shareholders amounts to some RM3.27 billion, or 75.2% of the half-year net profit of RM4.35 billion.”

On the group’s liquidity and capital strength, the lender said it continues to maintain a healthy liquidity position with a liquidity coverage ratio of 137.2% and loan-to-deposit ratio of 89.3%.

In terms of loans growth, Maybank said its Malaysian operations registered a steady 4.7% expansion in gross loans for 1H, outpacing the industry growth of 3.4%.

In Singapore, the loans growth registered an 8.7% upward trend in the first half, outpacing industry growth of 2.1%, while Indonesia registered a 15.0% decline as the economy continued to be impacted by the Covid-19 pandemic.

Maybank said its gross impaired loans ratio declined to 2.18% in June from 2.49% the same month in 2020, while its loan loss coverage as at June this year continued to register further improvement, reaching 114.8% from 90.5% a year earlier.

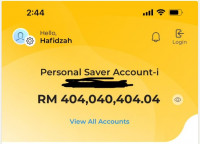

On the group’s Islamic banking business, Maybank said its pre-tax profit rose to RM2.34 billion in 1H compared with RM861.6 million a year earlier, and the segment saw total gross financing rising to RM211.1 billion.

“As at June 2021, Islamic financing constituted 63.8% of Maybank’s total domestic financing, with Maybank Islamic ranking No. 1 in Malaysia in terms of market share of Islamic assets at 29.3%.”

On its Etiqa Insurance and Takaful business, Maybank said the segment registered a 6.9% rise in net operating income to RM919.0 million for 1H.

It said as at August, some 27.1% of total financing in Malaysia was offered under its repayment assistance, relief, and rescheduling and restructuring programmes, with 15.3% in Indonesia and 6.1% in Singapore.

On the bank’s performance, chairman Tan Sri Zamzamzairani Mohd Isa said the group remains cautious about overall regional growth momentum given the sudden resurgence in Covid-19 cases in the last few months.

“Nonetheless, Maybank remains committed to assisting those affected through our financial solutions as well as community support, so that we can all navigate safely through this pandemic.”

Group president and chief executive Datuk Abdul Farid Alias said given the expectation of a more challenging 2H, the bank will continue its strategy of focusing on robust risk management, strengthening its capital, and growing its current and savings accounts deposit base to provide sufficient buffers for unexpected events.

“Moving forward, we will continue to strengthen our digital capabilities and pursuit of innovation, as well as accelerate our sustainability commitments, which we believe will provide us with a competitive edge in pursuing our growth agenda.” – Bernama, August 26, 2021