.png)

AIRASIA X Bhd’s (AAX) refusal to accede to airline industry regulator Malaysian Aviation Commission’s (Mavcom) demands that it reimburse customers for the advance payment of tickets engenders a situation that will result in customers eventually losing all the money they have paid as advance bookings.

As it is now, under a restructuring scheme that classifies customers as creditors, customers are only assured of getting 0.5% of the amount paid – RM5 for every RM1,000 with the minimum payment having to be RM50, which means most of them won’t get anything.

Unless, that is, AAX makes a huge turnaround – an event that is unlikely. In that extremely exceptional event, customers will be entitled to their proportionate profit share of 20% of those exceeding RM300 million a year, likely to be peanuts or nothing at all.

Mavcom has said long-haul, low-cost carrier AAX’s customers are not creditors, but customers who have made advance payments for services to be rendered.

Mavcom takes the view that air travel consumers ought not to be classified as ‘creditors’ as the air travel consumers did not, inter alia, sell any products, provide services, or make loans to AAX, but instead have paid monies for the purchase of tickets in advance of their flights. Accordingly, Mavcom reiterates its position that AAX should reimburse air travel consumers for the tickets purchased.”

But AAX, through its chief executive Benyamin Ismail, said it will not make refunds because it does not have enough cash flow to make the reimbursements.

There are two things to consider. One, customers make advance payments for tickets. Currently, these advance payments are used for the operating cash flow of airlines, something that should not be allowed as it is not their money to use until they have rendered the services.

Airlines have inappropriately used these payments all this while. But it was not an issue until they got into trouble and could not refund customers when the services were not rendered. Thus, it was the airlines’ misappropriation of the funds that led to the situation.

Second, does that make them creditors? As Mavcom has explained, they made advance payments for services to be rendered and therefore, should not be classified as creditors. In fact, the payments should be put in escrow in an account that cannot be touched until the service is provided.

It is still not too late. Mavcom should use its powers under the Malaysian Aviation Commission Act 2015 to ensure customers who made advance payments are not classified as creditors, and that their payments are reimbursed. This should be extended to all airlines that take advance payments.

As an immediate measure, all advance payments should be put in an escrow account. Otherwise, customers will continue to provide operating funds for low-cost and other airlines, all of whom – including AAX and sister company AirAsia – are in dire straits and could go bust at any time.

In this case, an escrow account is one where a third party controls the advance payments and ensures that payment is made only after the provision of the service in question.

Speed is of the essence for Mavcom to protect customers because airlines are in dire straits and many of them are likely to go under, taking with them the advance payments that customers have paid and are still paying for future flights that may not take off.

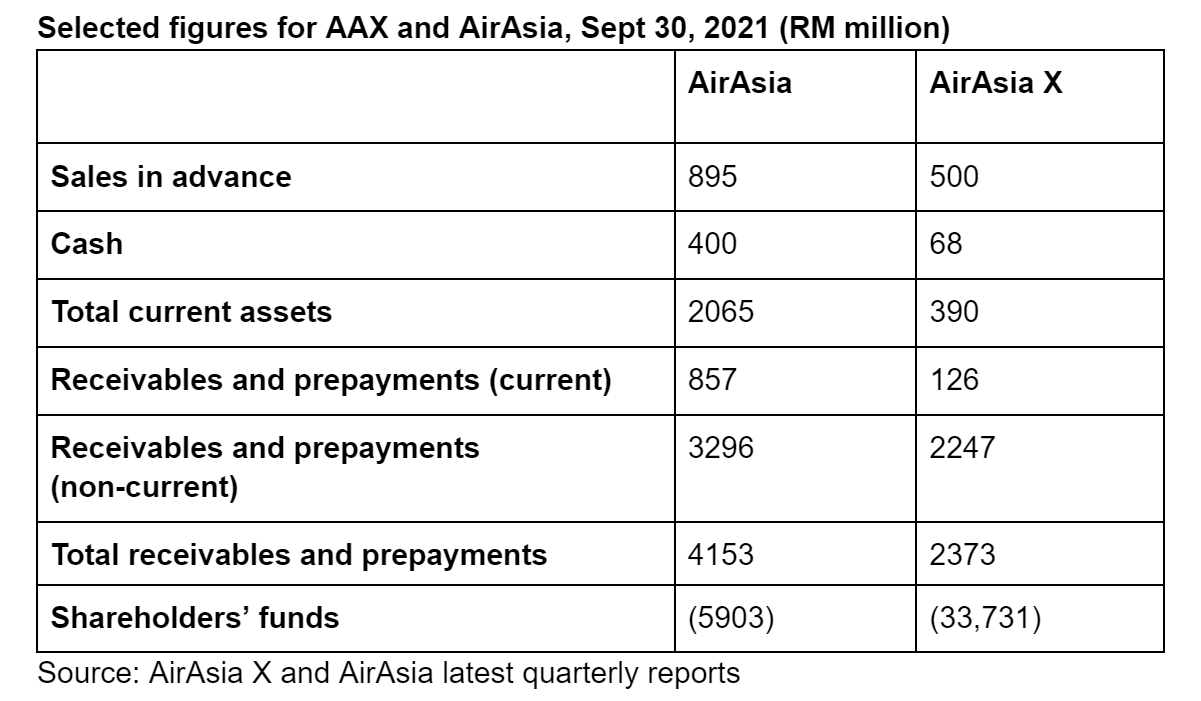

Take the example of AAX and AirAsia and look at the snapshot of their most recent financial positions. The stand-out figure is shareholders’ funds that are hugely negative because of massive provisions – a deficit of RM5.9 billion for AirAsia and a humongous deficit of RM33.7 billion for AAX.

AAX’s deficit arises mainly from a huge RM25.6 billion provision, which is explained thus in the account:

The group has made an estimated provision for termination of RM25.16 billion as of June 30 this year, where the group is in default under the terms of the relevant contracts, though the aforementioned provision will be waived upon a successful completion of the proposed debt restructuring exercise. In conjunction with the proposed debt restructuring exercise, the scheme creditors submitted proof of debt (including termination claims) amounting to RM65.14 billion. The scheme creditors are creditors of the group whose debts are to be dealt with under the proposed debt restructuring exercise.”

These claims are clearly related to aircraft purchase undertakings that are being repudiated. To lump customers who have paid in advance in cold, hard cash for tickets in the same category is grossly unfair and indefensible.

Let’s look at it this way. AirAsia head honcho Tan Sri Tony Fernandes was recently in the limelight over a Tesla car he was driving that is worth a few hundred thousand ringgit – small change for a billionaire. He was heavily criticised for this when advance ticket sales were not being refunded by his group of companies.

Let’s say Tesla had required payment of the car earlier because of high demand, and then the car was not delivered as expected for various reasons. Would Fernandes not expect to be fully reimbursed in cash? And if for any reason Tesla did not have the money to repay him, would he not be entitled to ask why and to rightfully get indignant and demand recompense?

Yes, on both counts. So AirAsia, AAX, and any other airline should reimburse customers when they can’t perform their services – for any reason. And Mavcom must ensure they pay up, and take the necessary steps to make sure they abide by this requirement.

It may not necessarily be accurate for AAX to maintain they cannot afford to pay – even so, they need to explain where the money went when it was an advance payment made for a very specific purpose.

Looking at the financial snapshot again, AAX had RM500 million in advance sales as at September 30. But it also had current assets (those which can be turned to cash quickly) of RM390 million, including cash totalling RM68 million, and current receivables and pre-payments of RM126 million. If you add in non-current receivables and pre-payments (those that take longer to realise in cash) of RM2247 million, they conceivably have enough resources to repay the RM500 million in advance sales.

Instead, it is talking about converting this RM500 million into a creditor amount, paying only RM5 per RM1,000 and a conversion into equivalent travel credits – if they are a going concern, which is a big “if”. The travel credits are not even a contractual obligation. Therefore, Mavcom should take immediate steps to freeze some of the airline’s assets to ensure customers are not embezzled out of what is rightfully theirs.

If we look at AirAsia, its sales in advance amount to RM895 million. But its cash totals RM400 million, while total receivables and pre-payments stand at a huge RM4.15 billion. It can easily afford to repay its customers immediately instead of dithering on payment.

AirAsia and other airlines should similarly be required by Mavcom to reimburse customers the moment they are unable to perform services, and to ensure that an escrow account be set up immediately for that purpose to ensure customers’ funds are safeguarded.

Mavcom will be failing in its duty to the public if it does anything otherwise. – The Vibes, November 26, 2021

P. Gunasegaram says long-suffering customers should not be forced to bail out and lose money trying to save airlines, as that’s a decision for true creditors, shareholders, venture capitalists, and the like. He is chief executive of research and advocacy group Sekhar Institute and senior editorial consultant of The Vibes