KUALA LUMPUR – A lawyer here received a rude shock after losing RM1 million in life savings stashed in a renowned international bank, raising fears over the security of large funds handled by priority banking services for high-net-worth individuals.

In an alarming revelation, S. Rajan (not his real name) alleged that RM1 million from his fixed deposit accounts were transferred to an unknown individual’s account without his knowledge or consent.

According to a police report sighted by The Vibes, the lawyer, in his 30s, said he visited the bank in Bangsar with his mother on April 7 this year to open the fixed deposit accounts.

The accounts were meant to remain open until the same date next year to allow interest on the funds to mature.

The report said the funds were entrusted to a relationship manager from the branch who would handle all banking matters related to him and his mother.

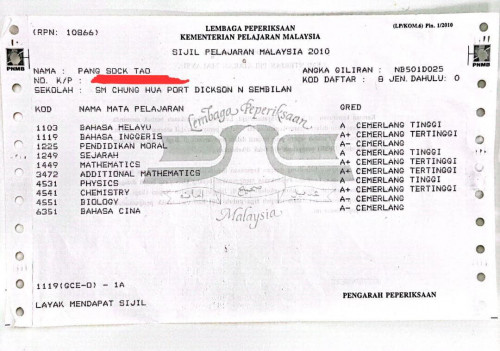

The bank had also subsequently issued two fixed deposit account certificates amounting to RM500,000 each.

Less than six months later, on October 1, the lawyer returned to the bank to check on the balance of both accounts.

“I found that the fixed deposit accounts had been liquidated on June 11 and June 25, and each without my or my mother’s knowledge.”

He said he was prompted to check the account balances after reading a story about a customer relationship manager with a similar name who had been charged with criminal breach of trust a week before the discovery.

Based on the lawyer’s banking records, the funds from both accounts were transferred to a third party, an individual unknown to him or his mother.

The names of the bank, customer relationship manager and account holder of the transferred funds are being witheld from this report to avoid compromising an ongoing probe into the case.

“The original certificates for the fixed deposit accounts are still in my possession,” he said.

The lawyer told The Vibes that the bank has responded to his complaint and promised to reimburse the funds along with due interest, but this depends on its internal investigation.

“The bank is not seen to be taking an active step in addressing this issue. That is frustrating as the only thing it tells us is that investigations are under way,” he said.

Meanwhile, an officer with the police’s Commercial Crime Investigation Department confirmed that an investigation paper has been opened into the case.

“There is not much to disclose (on the case yet). We are working out (the matter) with the bank,” the officer said.

The Vibes has also reached out to the bank’s strategic communications department for comment but have yet to receive any response at press time.

The lawyer said he and his mother are highly distraught over the incident as they believe they had exercised due diligence before parking their hard-earned money in a reputable bank.

“But it seems that our money is not safe, even when it is deposited in financial institutions recognised by Bank Negara.

“The fact that such an amount can easily be transferred without raising any red flags for months on end is highly baffling.” – The Vibes, October 24, 2021

Horror as lawyer’s RM1 mil in life savings transferred without consent

Renowned bank unaware funds moved until man checks accounts

Updated 2 years ago · Published on 24 Oct 2021 8:00AM